Unlock the Secrets of Fund Fact Sheet

and Pitchbook Automation

Investment managers need specialized functionality to automate fact sheets, pitchbooks, and other investor communications. Compare the top 3 vendors and learn how financial services companies implement content automation successfully.

In our exclusive content automation comparison research report, you’ll learn:

-

- Three different ways to approach content automation

- The pros and cons of each approach, with real insights from investment marketers

- A detailed comparison of the top 3 vendors: Kurtosys, Synthesis, and Seismic Software

“The Synthesis client services team is reliable and can deliver large projects with minimal specs on time. Synthesis was able to match our fact sheet specs exactly and render very unique and complex data visualizations.” – Synthesis Client

Why should investment managers read this content automation comparison report ?

Implementing the wrong content automation solutions is taxing on a firm’s resources, and can cost much more than expected. It can be difficult for asset management marketers to know exactly which approach will help them reach their goals. Therefore, Synthesis Technology created a report to help firms select the right vendor for their specific needs.

Throughout 2017, we conducted extensive research, gathering third-party data and interviews with clients of the financial industry’s top three solution providers: Kurtosys, Synthesis, and Seismic.

It will help investment management firms:

- Understand the three main approaches to content automation

- Avoid unreasonable expectations

- Set their firm up for successful implementations

What are the Different Approaches to Content Automation?

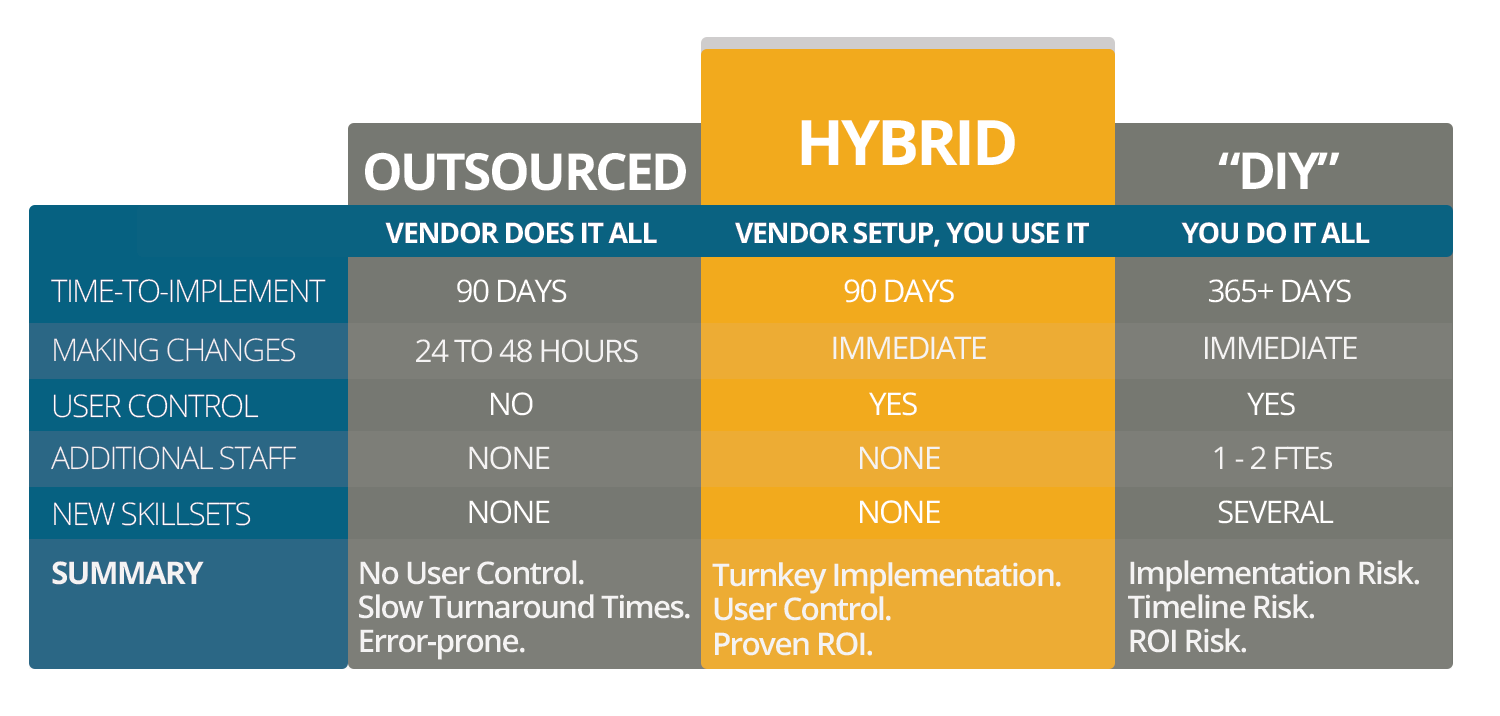

We talked to customers of all three vendors to see the differences between their approaches. In our report, we provide a comparison matrix on critical criteria such as:

- Implementation Methods

- Error Handling

- Data Visualization Capabilities

- Cost & Length of Implementation

- Output Quality